Embracing the 2023 QSEHRA: A Guide for Employers

Introduction

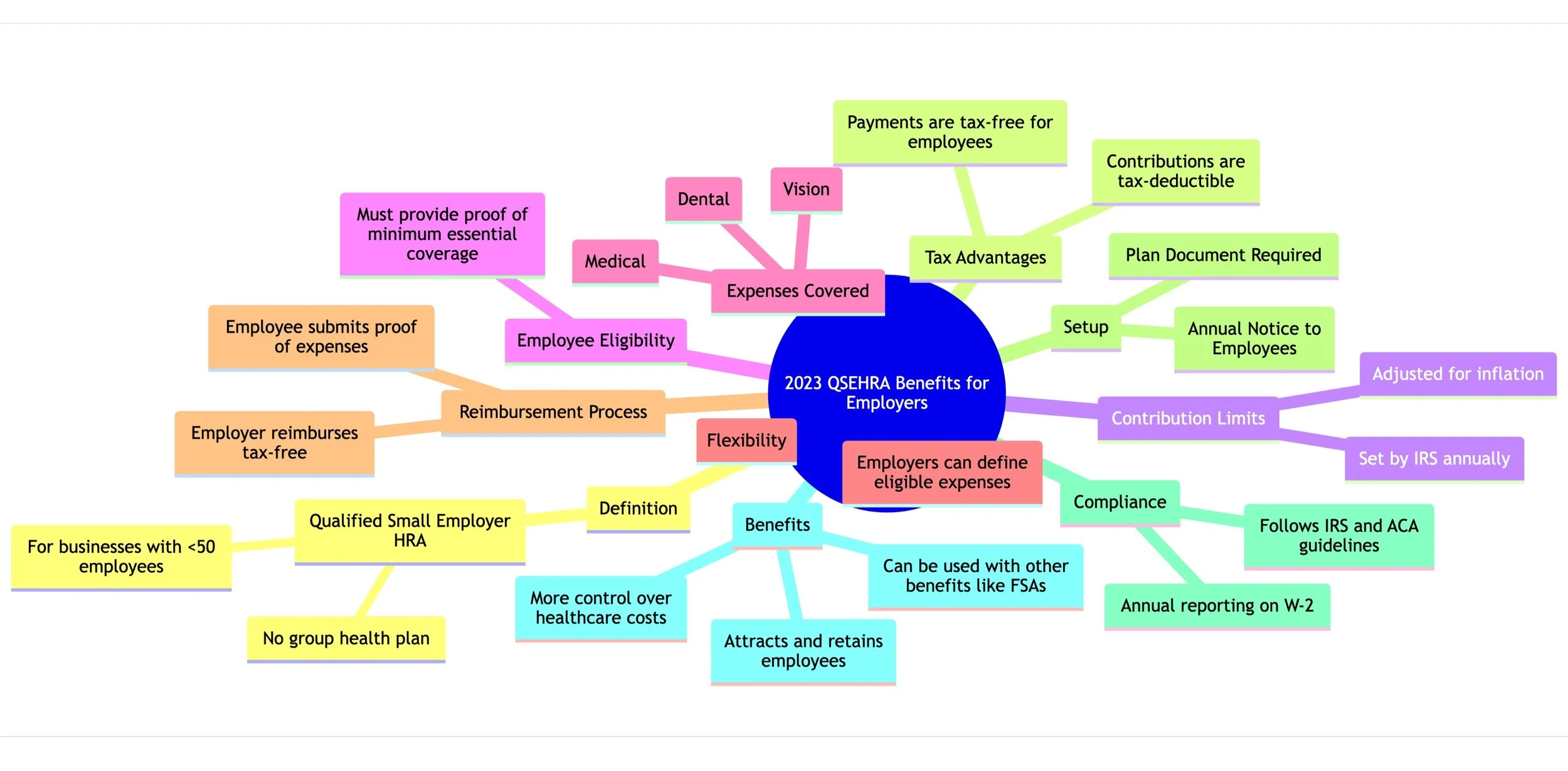

The Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a tax-advantaged benefit that small employers can offer to their employees for healthcare expenses. As we step into 2023, understanding the benefits, eligibility criteria, and claiming process of QSEHRA can help small businesses provide a valuable employee benefit while managing costs.

What is QSEHRA?

QSEHRA allows small employers with fewer than 50 full-time employees, who do not offer group health plans, to reimburse their employees' qualified medical expenses up to a certain limit. This arrangement is particularly beneficial for small businesses looking for flexible healthcare solutions.

Benefits for Employers

Tax Advantages: Contributions made by employers are tax-deductible, and reimbursements received by employees are tax-free, provided they have minimum essential coverage.

Contribution Limits: The IRS sets annual contribution limits, which are subject to inflation adjustments.

Attract and Retain Talent: Offering a QSEHRA can make a small business more attractive to current and prospective employees.

Control Over Costs: Employers can set their own budgets for reimbursements, giving them control over healthcare spending.

Employer Eligibility

To be eligible to offer a QSEHRA, employers must:

Have fewer than 50 full-time employees.

Not offer a group health plan to any of their employees.

Employee Eligibility

Employees must have minimum essential coverage to participate and receive tax-free reimbursements from a QSEHRA.

Expenses Covered

QSEHRA can cover a range of medical expenses, including:

Medical care expenses like doctor visits and prescriptions.

Dental and vision care expenses.

How to Claim QSEHRA Benefits

Set Up the Arrangement: Employers must create a written plan document that outlines the QSEHRA's terms.

Provide Annual Notice: Employees must be informed about the QSEHRA annually.

Reimbursement Process: Employees submit proof of their medical expenses, and employers reimburse them up to the set limit.

Compliance

Employers offering a QSEHRA must adhere to IRS and Affordable Care Act (ACA) guidelines and report contributions on employees' W-2 forms.

Conclusion

The QSEHRA presents a unique opportunity for small employers to offer a cost-effective healthcare benefit. By following the guidelines for eligibility and claiming the benefits, employers can leverage QSEHRA to support their employees' health needs while enjoying tax benefits.