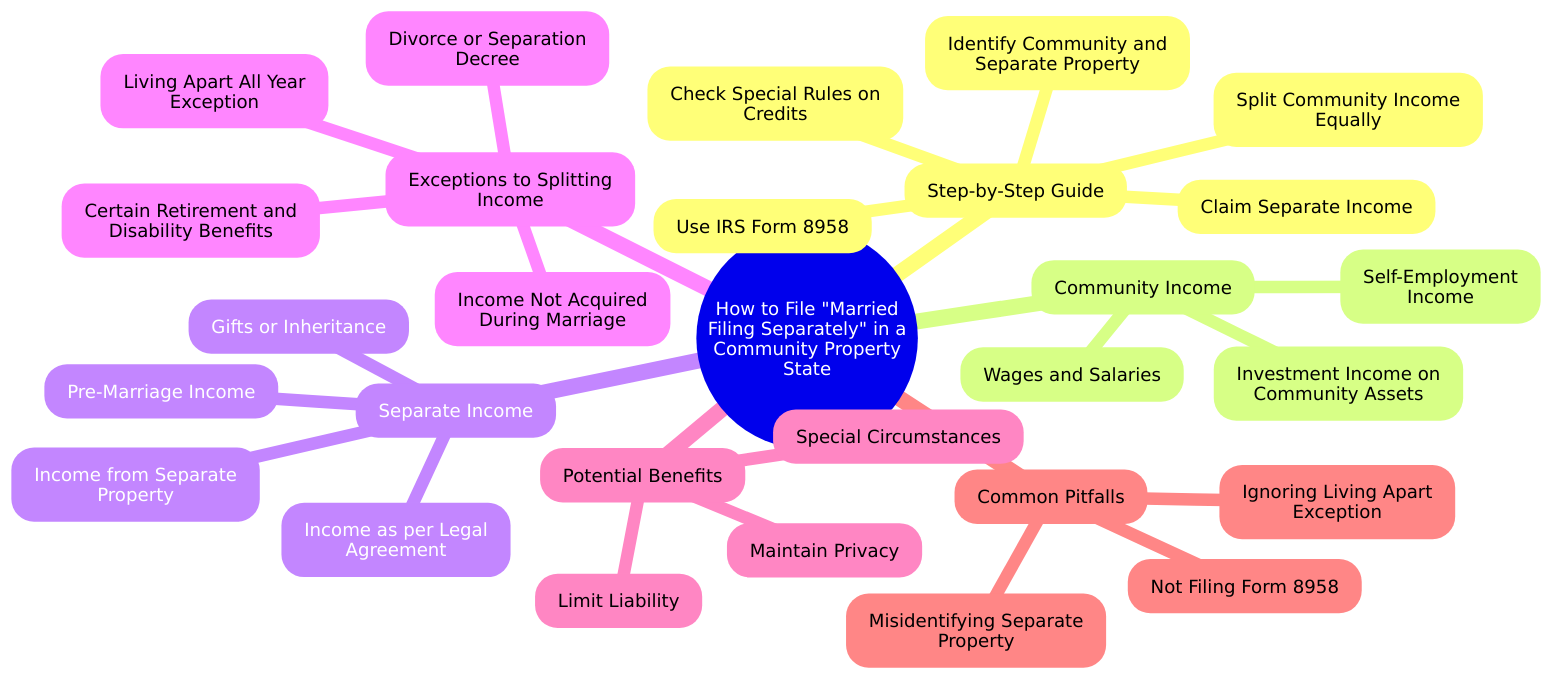

How to File “Married Filing Separately” Correctly in a Community Property State (Including Exceptions to Split Income)

Filing “Married Filing Separately” (MFS) in a community property state can be tricky due to the unique rules governing how income and deductions are split between spouses. When living in a community property state, most income earned by either spouse during the marriage is considered jointly owned and must typically be divided equally on separate tax returns. However, there are exceptions to this rule that can significantly affect how income is reported.

This article will explain how to file MFS in a community property state, how community property laws impact your taxes, and when income can avoid being split. We’ll also cover how to correctly claim deductions and file your return.

Who Is This Article For?

This guide is helpful for:

• Married couples in community property states who want to file separate tax returns but need clarity on income-splitting rules.

• Taxpayers concerned about their spouse’s tax liabilities who prefer to limit their own responsibility by filing MFS.

• Couples with complex financial arrangements, including separate property or income from prior to the marriage, inheritance, or divorce settlements.

What Is a Community Property State?

Community property laws apply in nine states:

1. Arizona

2. California

3. Idaho

4. Louisiana

5. Nevada

6. New Mexico

7. Texas

8. Washington

9. Wisconsin

In these states, property acquired and income earned during the marriage generally belongs equally to both spouses, even if only one spouse worked or earned it. This means most income and deductions must be split 50/50 between spouses when they file separately.

However, there are key exceptions to this splitting rule that may allow one spouse to report certain income solely on their own return.

Key Differences When Filing “Married Filing Separately” in a Community Property State

Under community property rules, community income (the income earned by either spouse during the marriage) is typically split equally between spouses. But not all income falls under the community umbrella. Separate income, or income that is exempt from being split, can stay with the spouse who earned or owns it.

Here’s how to handle both types of income and deductions:

1. Community Income

Community income includes most types of earnings and applies to:

• Wages and salaries

• Self-employment income

• Investment income (such as dividends or interest) earned on community assets

2. Separate Income

Certain income does not need to be split 50/50, even if you’re in a community property state. This is called separate income, and it can include:

• Income earned before the marriage: Wages or other earnings from before you got married remain separate.

• Gifts or inheritance: Any income from gifts or inheritance received by one spouse during the marriage is typically treated as separate income.

• Assets or investments owned before marriage: Income generated from separate property (such as a rental property owned before the marriage) does not have to be split.

• Income designated as separate by a pre- or post-nuptial agreement: If spouses have a legal agreement defining certain property as separate, income from that property may remain separate.

3. Community Deductions

Deductions, like income, generally need to be split 50/50 if they are community expenses, such as:

• Mortgage interest

• Property taxes

• Charitable donations paid from joint funds

4. Separate Deductions

Expenses paid from separate funds (such as funds owned before marriage or from separate property) are claimed solely by the spouse who incurred the cost.

Exceptions to the Income-Splitting Rule

While community income must generally be split evenly, there are several important exceptions that can keep certain income on one spouse’s return:

1. Living Apart All Year Exception

If you and your spouse lived apart for the entire year and did not file a joint return, special rules apply. The IRS allows you to treat income as separate if:

• You did not live together at any time during the year.

• You did not transfer funds or services to each other during the year.

• You file separately.

In this case, all income earned during the year can be treated as separate income for tax purposes, even in a community property state. This is a common exception for couples who are separated or going through a divorce but are not yet legally divorced.

2. Divorce or Separation Decree

If you have a divorce or legal separation decree that explicitly allocates income or property as separate, that income does not need to be split. The decree must clearly define the separate property or income of each spouse, which can override the default community property rules.

3. Income from Separate Property

As mentioned earlier, income from property that was owned before the marriage or that is clearly separate due to inheritance or gifts is not considered community income. If you have investments or assets that generate income and are classified as separate property, this income remains solely yours to report.

4. Certain Retirement and Disability Benefits

Some retirement benefits (like certain military disability pensions) may be considered separate income, depending on the terms of the retirement or disability agreement. This is another area where a legal agreement, such as a divorce settlement, can help define the income as separate.

Steps to File Correctly

1. Identify Community and Separate Property

• Review all sources of income and deductions to determine which are community and which are separate.

• Use the exceptions listed above to ensure you do not unnecessarily split separate income.

2. Split Community Income and Deductions Equally

• If the income is classified as community, report half of the total community income and deductions on each spouse’s return.

3. Claim Separate Income and Deductions for Yourself

• Separate income, such as pre-marital earnings or inheritance, is not subject to the 50/50 rule and should be reported only by the spouse who earned or received it.

4. Use IRS Form 8958: Allocation of Tax Amounts Between Married Filing Separately Spouses in Community Property States

• This form is used to properly allocate income, deductions, and credits between spouses. It must be attached to your return to clearly show how the income was split.

5. Check for Special Rules on Credits

• Some tax credits, such as the Earned Income Tax Credit (EITC) and education credits, are not allowed or are limited when filing MFS. Review which credits apply to your situation.

Common Pitfalls to Avoid

• Misidentifying Separate Property: Failing to correctly classify separate property income, or incorrectly splitting it, can result in inaccurate returns and potential penalties.

• Ignoring the Living Apart Exception: If you lived apart from your spouse for the entire year, you may be able to keep all of your income as separate without splitting—don’t overlook this opportunity.

• Not Filing Form 8958: This form is crucial for taxpayers in community property states filing separately. Without it, the IRS may flag discrepancies in how income was reported between spouses.

Why File Separately?

Filing MFS in a community property state can be complex, but couples may choose this filing status for several reasons:

• Limit liability: Each spouse is responsible only for their own tax liability, which can help protect you if your spouse owes back taxes or has significant tax issues.

• Maintain privacy: If you have separate businesses or investments, you may prefer to keep financial matters private by filing separately.

• Special circumstances: Divorce or separation, particularly with complex assets, often makes filing separately the best choice.

Conclusion: Navigate Community Property Rules and Exceptions

Filing “Married Filing Separately” in a community property state requires careful attention to community property laws, especially when exceptions apply. Understanding when you must split income and when you can claim it separately is crucial for accurate tax filing. Use IRS Form 8958 to allocate income correctly, and consult a tax professional if your situation is complicated or you need help navigating the exceptions.