Simplifying S Corp Contributions, Distributions, and Basis

Introduction

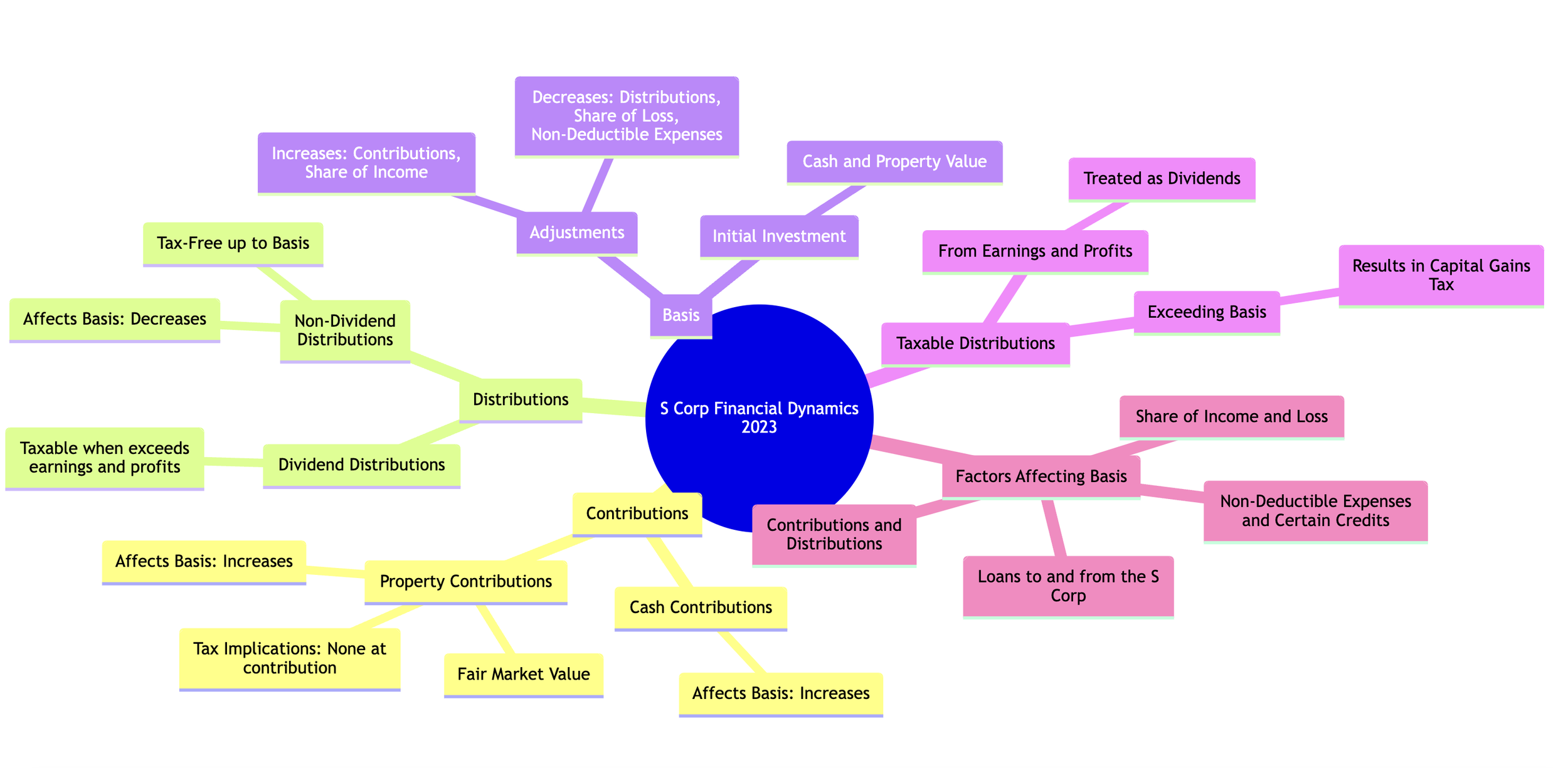

Navigating the financial and tax aspects of an S Corporation (S Corp) can be complex, especially when it comes to contributions, distributions, and understanding shareholder basis. This article aims to demystify these concepts, focusing particularly on the critical aspect of shareholder basis and its implications for tax reporting and financial planning.

S Corp Contributions

Contributions to an S Corp are typically made by shareholders to provide capital for the business. These contributions can be in the form of cash, property, or services and have specific tax implications.

Cash and Property: Increase the shareholder's basis in the S Corp.

Services: If services are contributed in exchange for stock, the shareholder must recognize income equal to the fair market value of the stock received.

S Corp Distributions

Distributions are payments made by the S Corp out of its earnings and profits to shareholders. The tax treatment of distributions depends on the shareholder's basis in the S Corp.

Distributions Not Exceeding Basis: Generally not taxable.

Distributions Exceeding Basis: Considered capital gains and subject to taxation.

Understanding Shareholder Basis

The basis is essentially the shareholder's stake in the S Corp, measured in dollars. It's crucial for determining the tax implications of distributions and losses.

Initial Basis

The initial basis is determined by the amount of capital the shareholder contributes to the S Corp, including both cash and the fair market value of any property contributed.

Adjustments to Basis

The shareholder's basis is not static; it's adjusted annually based on the S Corp's operations and activities, including:

Increases: Share of income, tax-exempt income, and additional contributions.

Decreases: Share of loss, non-deductible expenses, and distributions.

Why Basis Matters

Loss Limitation: Shareholders can only deduct losses up to their basis in the S Corp. Any losses exceeding this basis are carried forward to future tax years.

Distributions: The taxability of distributions depends on the shareholder's basis, with distributions exceeding the basis being taxable.

When Basis is Affected

Several events can affect a shareholder's basis:

Contributions and Distributions: As mentioned, these directly impact the basis.

Income and Losses: The share of the S Corp's income increases basis, while losses decrease it.

Loans: Loans made by shareholders to the S Corp can affect the basis, though the rules are complex and depend on the loan's terms and the shareholder's ability to bear the economic risk of loss.

How to Claim and Report

Form 1120S: S Corps report income, losses, deductions, and credits to the IRS on Form 1120S.

Schedule K-1: Each shareholder receives a Schedule K-1 showing their share of the S Corp's financial activity, which they then report on their personal tax return. This includes information necessary for adjusting the shareholder's basis.

Conclusion

Understanding your basis in an S Corp is essential for making informed decisions about contributions, distributions, and tax planning. Regularly tracking and adjusting your basis ensures compliance with tax laws and helps optimize your tax situation. Given the complexity of these issues, consulting with a tax professional who can provide personalized advice based on your specific circumstances is advisable.