Standard vs. Itemized Deductions: A 2023 Guide to Maximizing Your Tax Benefits

Introduction

Navigating the complexities of tax deductions is crucial for minimizing your tax bill and maximizing your return. In 2023, taxpayers face the annual decision: take the standard deduction or itemize deductions. This guide will help you understand both options, focusing on the benefits, eligibility, and how to claim them, with a detailed look into itemized deductions.

Standard Deduction: Simplify Your Tax Filing

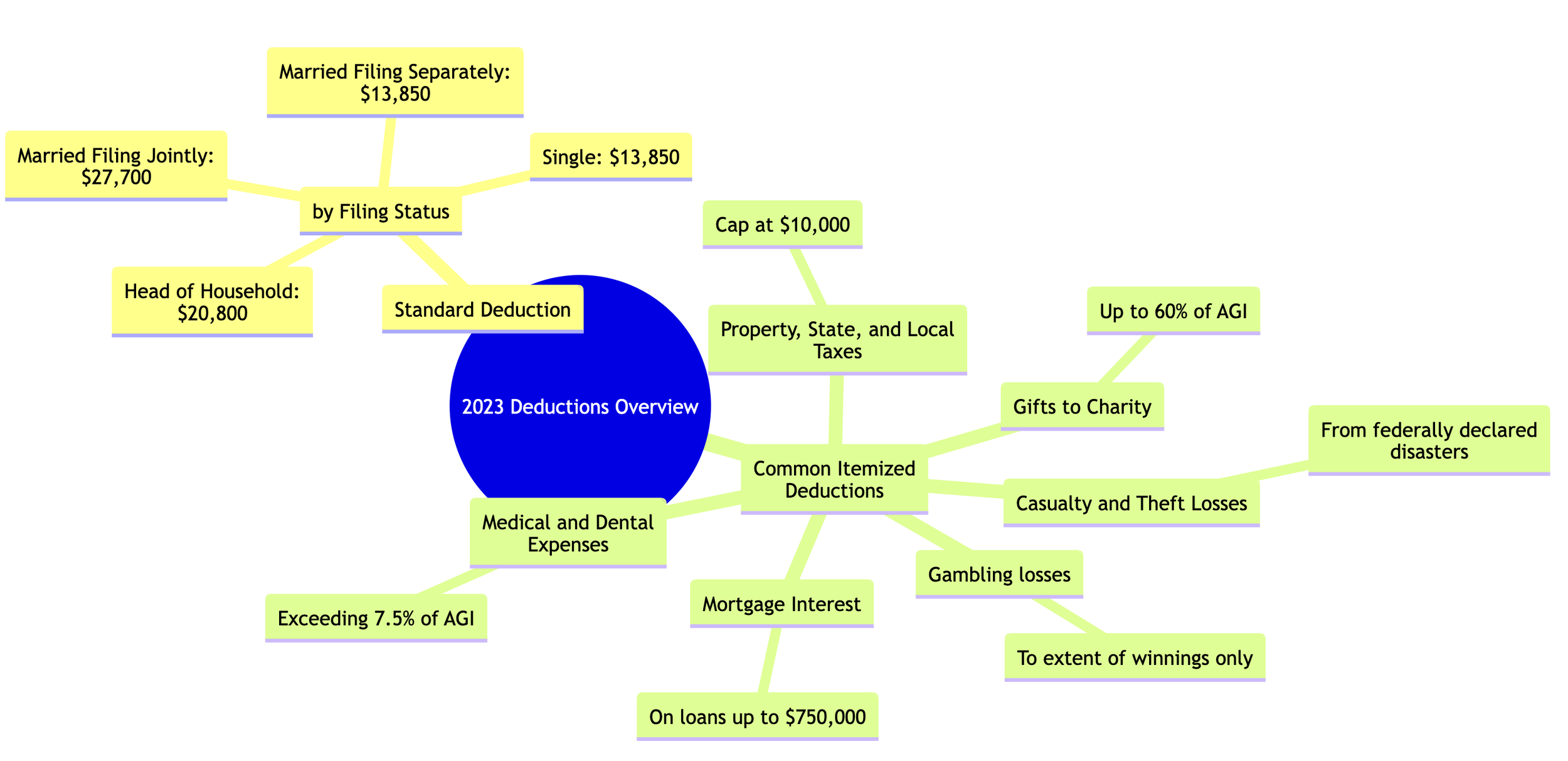

The standard deduction is a fixed amount that reduces your taxable income. It's available to all taxpayers and varies based on your filing status. In 2023, the amounts are:

Single: $13,850

Married Filing Jointly: $27,700

Head of Household: $20,800

Married Filing Separately: $13,850

Benefits

Simplicity: No need to keep detailed records or receipts.

Time-saving: Simplifies the tax filing process.

Guaranteed: Everyone qualifies for the standard deduction.

Eligibility

All taxpayers are eligible for the standard deduction, making it an appealing choice for those without significant deductible expenses.

Itemized Deductions: Tailor Your Tax Breaks

Itemizing allows taxpayers to deduct eligible expenses that exceed the standard deduction. It requires more detailed record-keeping but can lead to greater tax savings.

Common Itemized Deductions

State and Local Taxes (SALT): Deduct up to $10,000 for singles or married filing jointly ($5,000 for married filing separately).

Mortgage Interest: On loans up to $750,000.

Charitable Contributions: Up to 60% of your adjusted gross income (AGI).

Medical and Dental Expenses: Exceeding 7.5% of AGI.

Casualty and Theft Losses: From federally declared disasters.

Benefits

Potential for Greater Deductions: Can exceed the standard deduction, lowering your tax bill.

Flexibility: Choose from various deductions to best suit your financial situation.

Eligibility

Beneficial for taxpayers with deductible expenses exceeding their standard deduction amount. Requires detailed documentation of expenses.

How to Claim

Standard Deduction: Automatically applied based on your filing status.

Itemized Deductions: Must file IRS Form 1040 and Schedule A, detailing each deductible expense.

Choosing Between Standard and Itemized Deductions

Assess Your Expenses: Total your deductible expenses to see if they exceed the standard deduction.

Consider Your Filing Status: Some statuses have higher standard deductions, making itemizing less beneficial.

Evaluate the Effort: Itemizing requires more work and documentation. Ensure the potential savings are worth the extra effort.

Conclusion

The choice between standard and itemized deductions is a pivotal decision in your tax planning strategy. For many, the standard deduction offers a hassle-free way to reduce taxable income. However, if you have significant deductible expenses, itemizing could provide substantial savings. Carefully review your financial situation and consult with a tax professional to make the most informed decision for 2023.