The 2023 Paid Leave Credit: A Simple Guide

Introduction

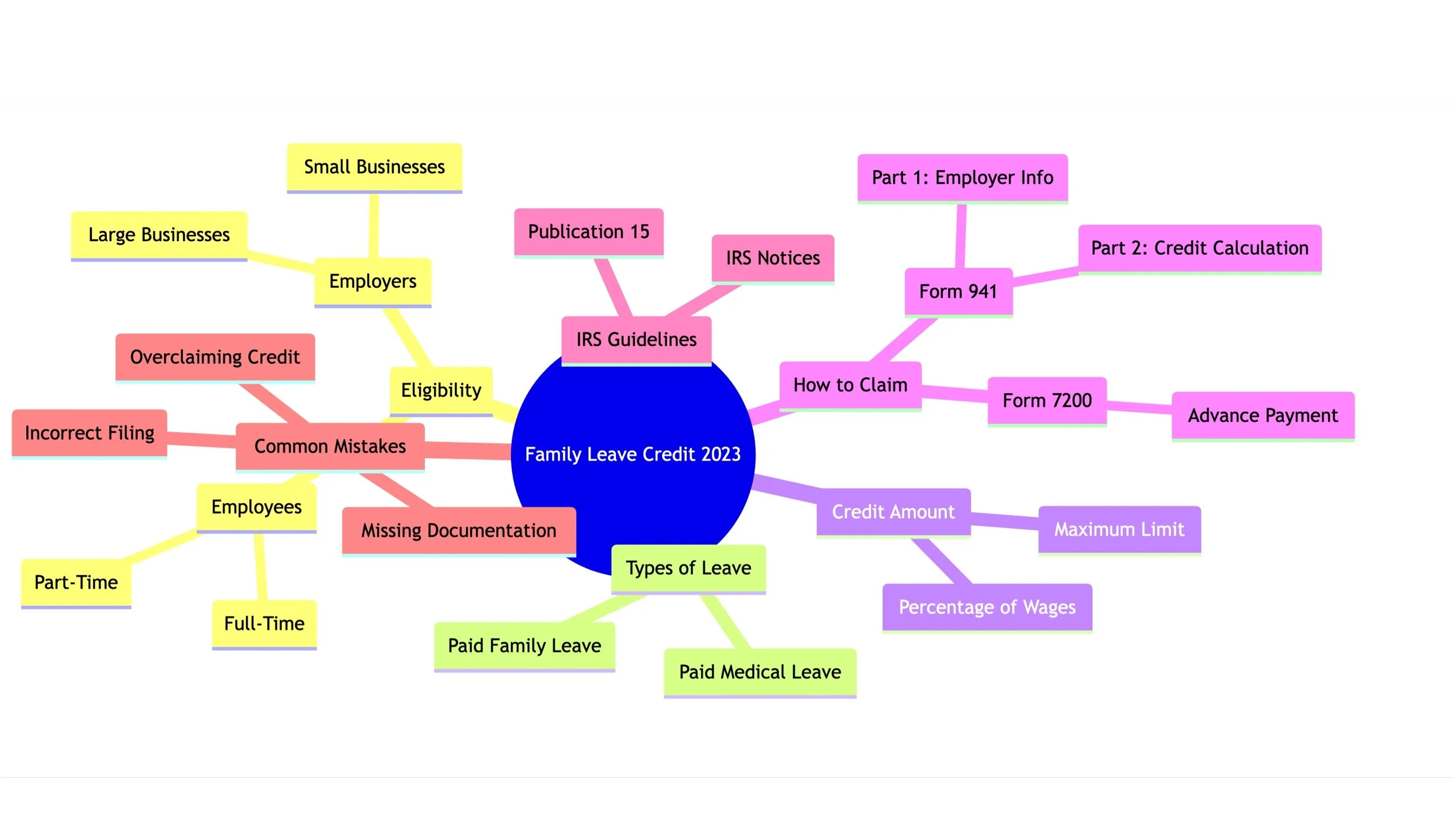

The Paid Leave Credit is a tax incentive designed to encourage employers to provide paid leave to their employees for family and medical reasons. In this article, we'll break down the eligibility criteria, types of leave covered, and the steps to claim this credit for the 2023 tax year.

Eligibility Criteria

For Employers

Small Businesses: Generally, businesses with fewer than 500 employees are eligible.

Large Businesses: Some larger businesses may also qualify based on specific conditions.

For Employees

Full-Time Employees: Eligible for the full credit amount.

Part-Time Employees: May be eligible for a prorated credit amount.

Types of Leave Covered

Paid Family Leave

Maternity and paternity leave, caring for a family member, etc.

Paid Medical Leave

Leave taken for medical treatment, recovery, or quarantine.

Credit Amount

Percentage of Wages: The credit covers a percentage of the employee's wages during the leave period.

Maximum Limit: There is a cap on the total credit amount that can be claimed per employee.

How to Claim the Credit

Form 941

Employers should use Form 941 to claim the Paid Leave Credit.

Part 1: Employer Information

Part 2: Credit Calculation

Form 7200

For advance payment of the credit, use Form 7200.

IRS Guidelines

For more detailed information, consult IRS Publication 15 and relevant IRS notices.

Common Mistakes to Avoid

Incorrect Filing: Ensure you're using the correct forms and schedules.

Missing Documentation: Keep records of the leave provided.

Overclaiming Credit: Make sure you're not claiming more than you're eligible for.

Conclusion

The Paid Leave Credit offers valuable financial relief for employers who provide paid family and medical leave to their employees. Understanding the eligibility criteria and claiming process can help you maximize this benefit. Always consult a tax professional for personalized advice.