Understanding the 2023 Adoption Tax Credit: Eligibility and How to Claim It

Introduction

Adoption is a life-changing experience, but it can also be financially challenging. The good news is that the U.S. government offers an Adoption Tax Credit to help offset some of these costs. In this article, we'll break down the essentials of the 2023 Adoption Tax Credit, including eligibility criteria and the steps to claim it.

What is the Adoption Tax Credit?

The Adoption Tax Credit is a federal tax credit designed to help families cover the costs associated with adopting a child. For 2023, the maximum credit amount is expected to be around $14,890 per child, although this is subject to income limitations.

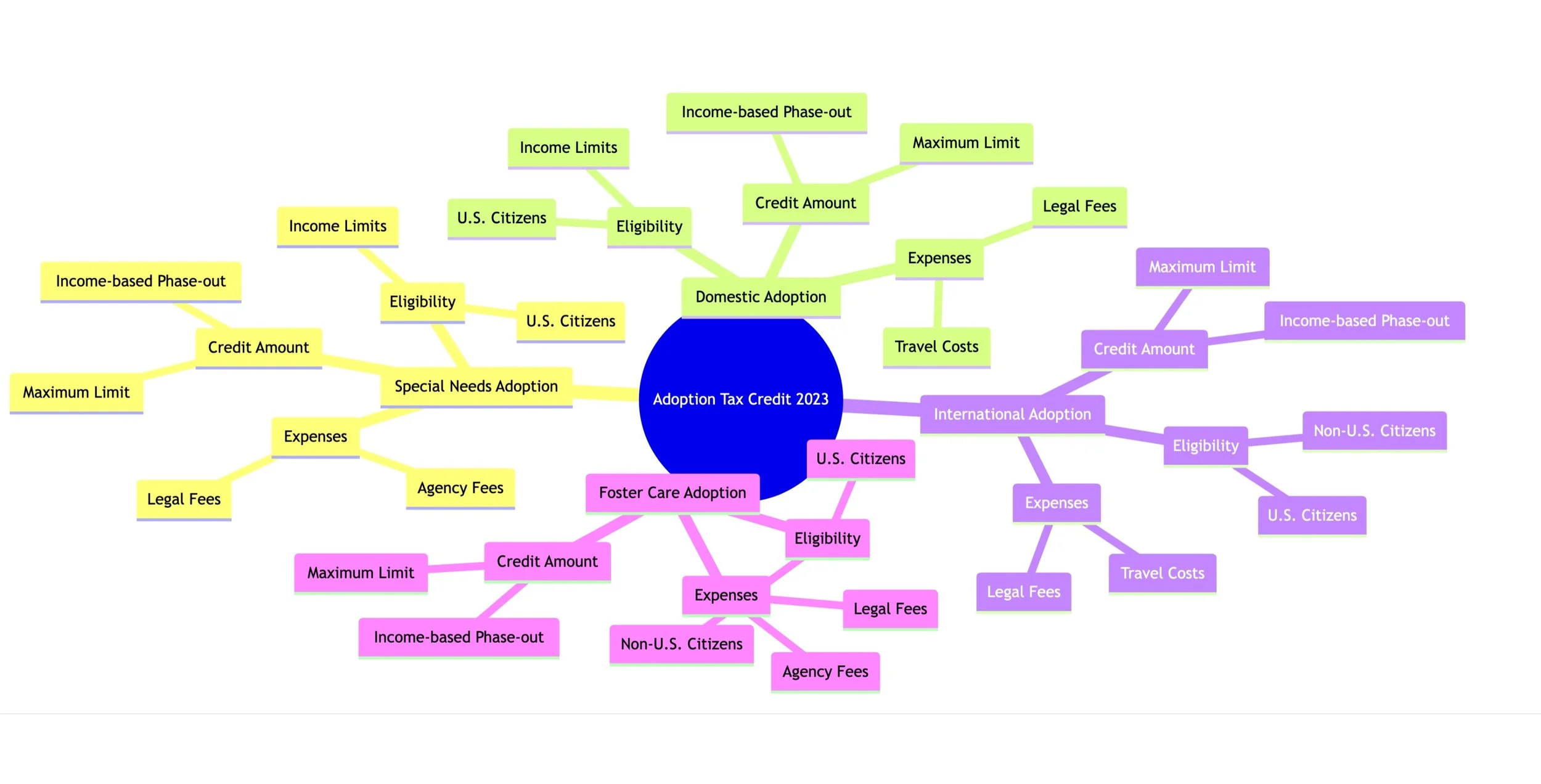

Types of Adoption Covered

Domestic Adoption

Eligibility: U.S. citizens

Expenses: Legal fees, travel costs

Credit Amount: Up to the maximum limit, income-based phase-out applies

International Adoption

Eligibility: U.S. citizens and non-U.S. citizens

Expenses: Legal fees, travel costs

Credit Amount: Up to the maximum limit, income-based phase-out applies

Special Needs Adoption

Eligibility: U.S. citizens

Expenses: Legal fees, agency fees

Credit Amount: Up to the maximum limit, income-based phase-out applies

Foster Care Adoption

Eligibility: U.S. citizens and non-U.S. citizens

Expenses: Legal fees, agency fees

Credit Amount: Up to the maximum limit, income-based phase-out applies

Eligibility Criteria

Primary Residence: The child must be adopted into a home that serves as the primary residence.

Income Limits: There are income limitations based on your modified adjusted gross income (MAGI).

Type of Adoption: The credit varies depending on whether it's a domestic, international, special needs, or foster care adoption.

How to Claim the Credit

Check Eligibility: Review IRS guidelines to ensure you meet the criteria.

Gather Documents: Collect all necessary receipts, invoices, and legal documents.

Fill Out IRS Form 8839: This is the form used to claim the Adoption Tax Credit.

Attach to Tax Return: Include Form 8839 when you file your federal tax return.

Wait for Approval: Once submitted, wait for IRS approval. If approved, the credit will be applied to your tax liability.

Conclusion

Adopting a child is a significant commitment, both emotionally and financially. The Adoption Tax Credit for 2023 aims to ease some of this financial burden. Make sure you understand the eligibility criteria and the process to claim this valuable credit.