Child Care Tax Credit Explained

Introduction

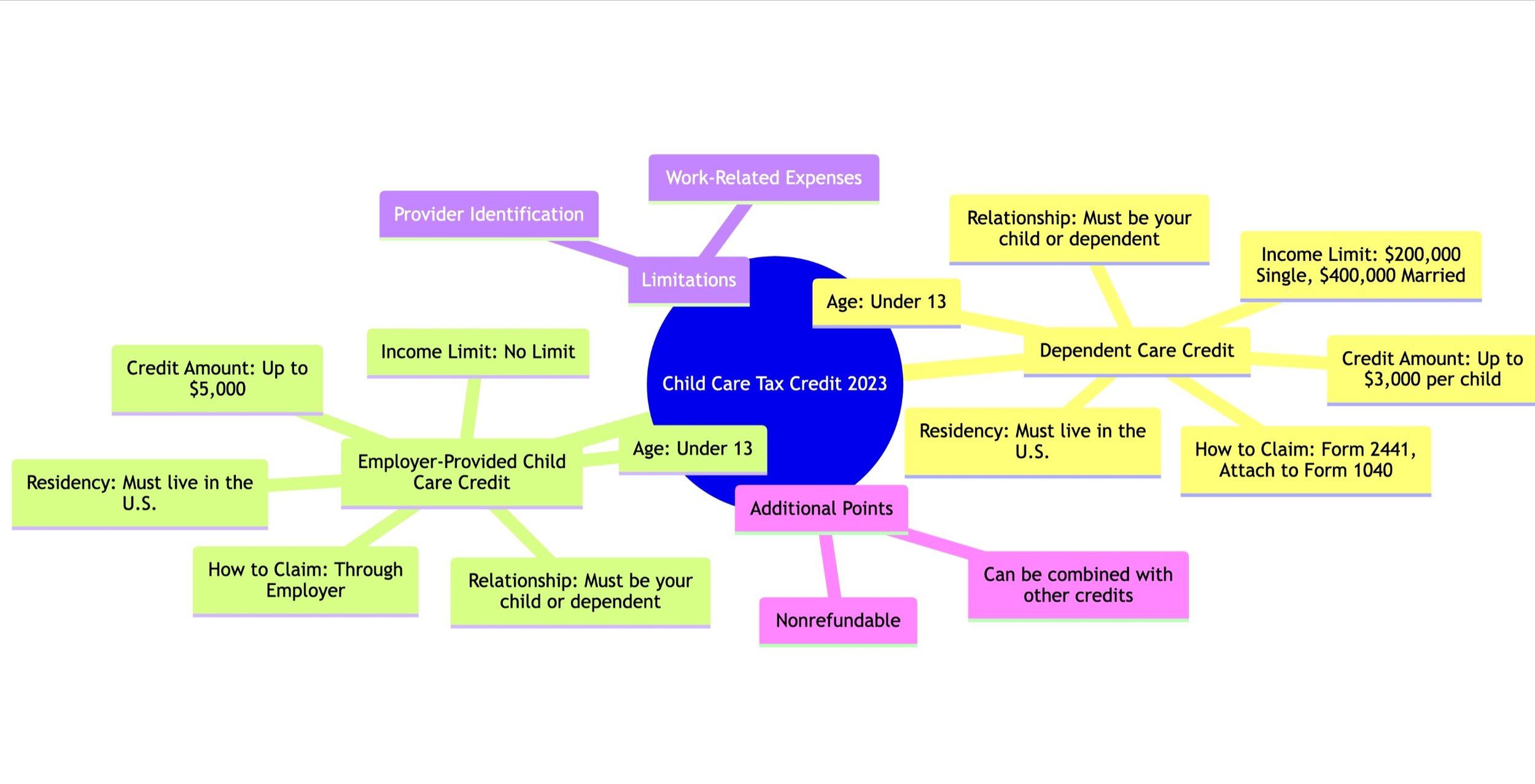

The Child Care Tax Credit is a financial relief mechanism designed to help parents offset the costs of child care. The credit comes in different types, each with its own set of eligibility criteria and claiming process. This article aims to simplify these aspects for the tax year 2023.

Types of Child Care Tax Credits

Dependent Care Credit

This is the most common type of child care tax credit. It's designed for parents who have to pay for child care in order to work or look for work.

Employer-Provided Child Care Credit

Some employers offer child care benefits. This credit is designed for those who receive child care assistance from their employer.

Eligibility Criteria

Dependent Care Credit

Income Limit: $200,000 for singles and $400,000 for married couples filing jointly.

Relationship: Must be your child or dependent.

Age: Under 13.

Residency: Must live in the U.S.

Credit Amount: Up to $3,000 per child, or up to $6,000 for two or more children.

Employer-Provided Child Care Credit

Income Limit: No income limit.

Relationship: Must be your child or dependent.

Age: Under 13.

Residency: Must live in the U.S.

Credit Amount: Up to $5,000.

How to Claim

Dependent Care Credit

File Form 2441 and attach it to your Form 1040.

Employer-Provided Child Care Credit

The credit is usually applied through your employer, so consult your HR department for the specific claiming process.

Limitations and Additional Points

The credits are nonrefundable, meaning they can reduce your tax liability but won't result in a refund.

Both credits can be combined with other tax credits you may be eligible for.

Ensure you have proper identification for your child care provider.

Conclusion

Understanding the types of Child Care Tax Credits, their eligibility criteria, and how to claim them can help you make the most of this financial benefit. Always consult a tax professional for personalized advice.