2023 Child Tax Credits Explained: A Simple Guide

Introduction

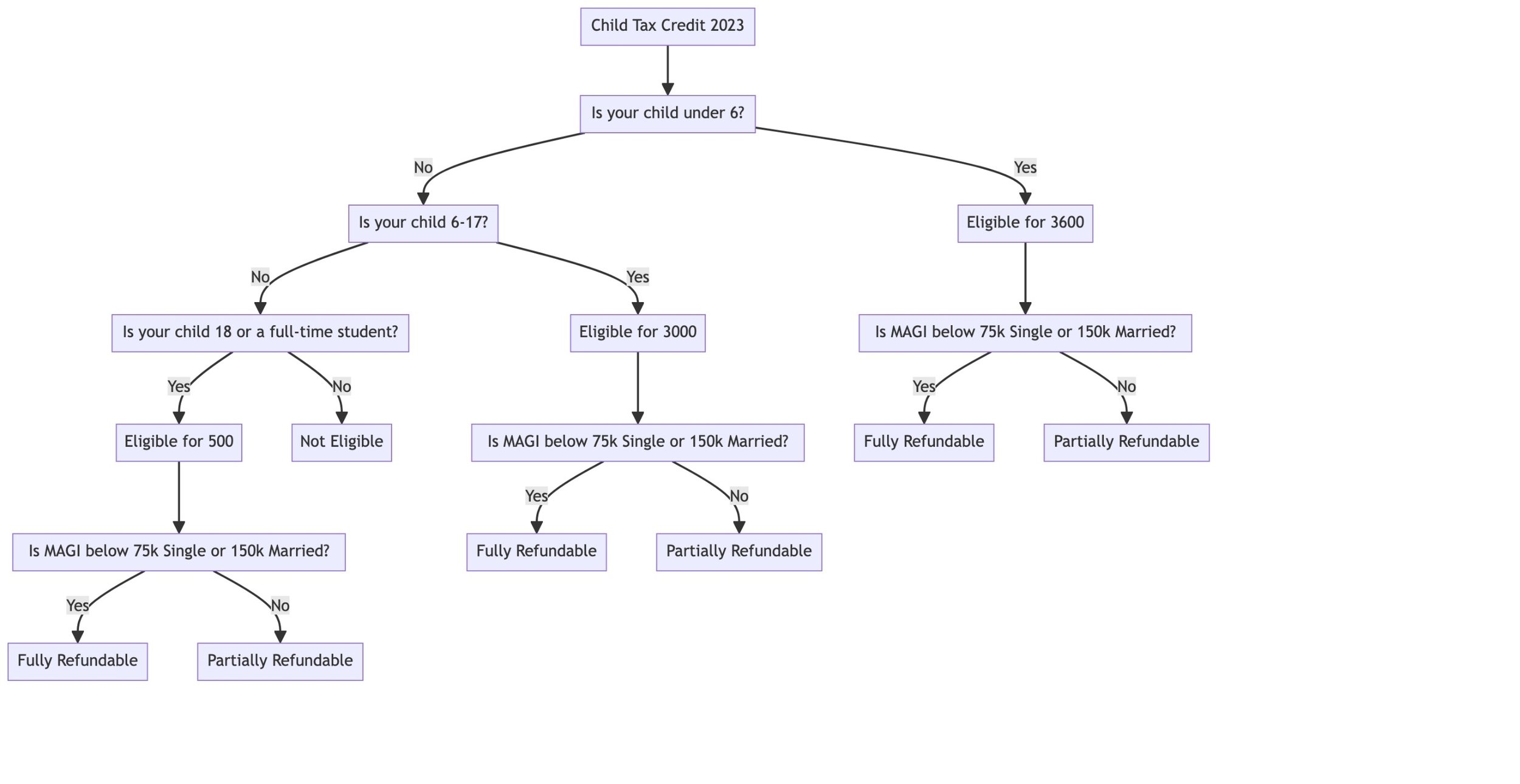

The Child Tax Credit (CTC) is a financial relief program designed to help families with children. For the tax year 2023, the CTC has undergone some changes that you should be aware of. This article will guide you through the types of credits, eligibility criteria, and how to claim them.

Types of Child Tax Credits

Fully Refundable Credit:

Amount: $3,600 for children under 6 years, $3,000 for children aged 6-17.

Eligibility: Modified Adjusted Gross Income (MAGI) must be below $75,000 for singles and $150,000 for married couples.

Partially Refundable Credit:

Amount: $1,000 for children under 17.

Eligibility: No income limit.

Non-Refundable Credit:

Amount: $500 for children who are 18 or full-time students.

Eligibility: No income limit.

Eligibility Criteria

The child must have a Social Security Number (SSN).

The child must live with you for more than six months of the year.

How to Claim

Form 8812: This is the primary form used to claim the Child Tax Credit.

Attach to Form 1040: Once you've filled out Form 8812, attach it to your main tax return form, which is the 1040.

Limitations

The child must have an SSN.

The child must live with you for more than six months of the year.

Conclusion

Understanding the Child Tax Credit for 2023 can provide significant financial relief for families. Make sure to check your eligibility and claim the credit when you file your taxes.