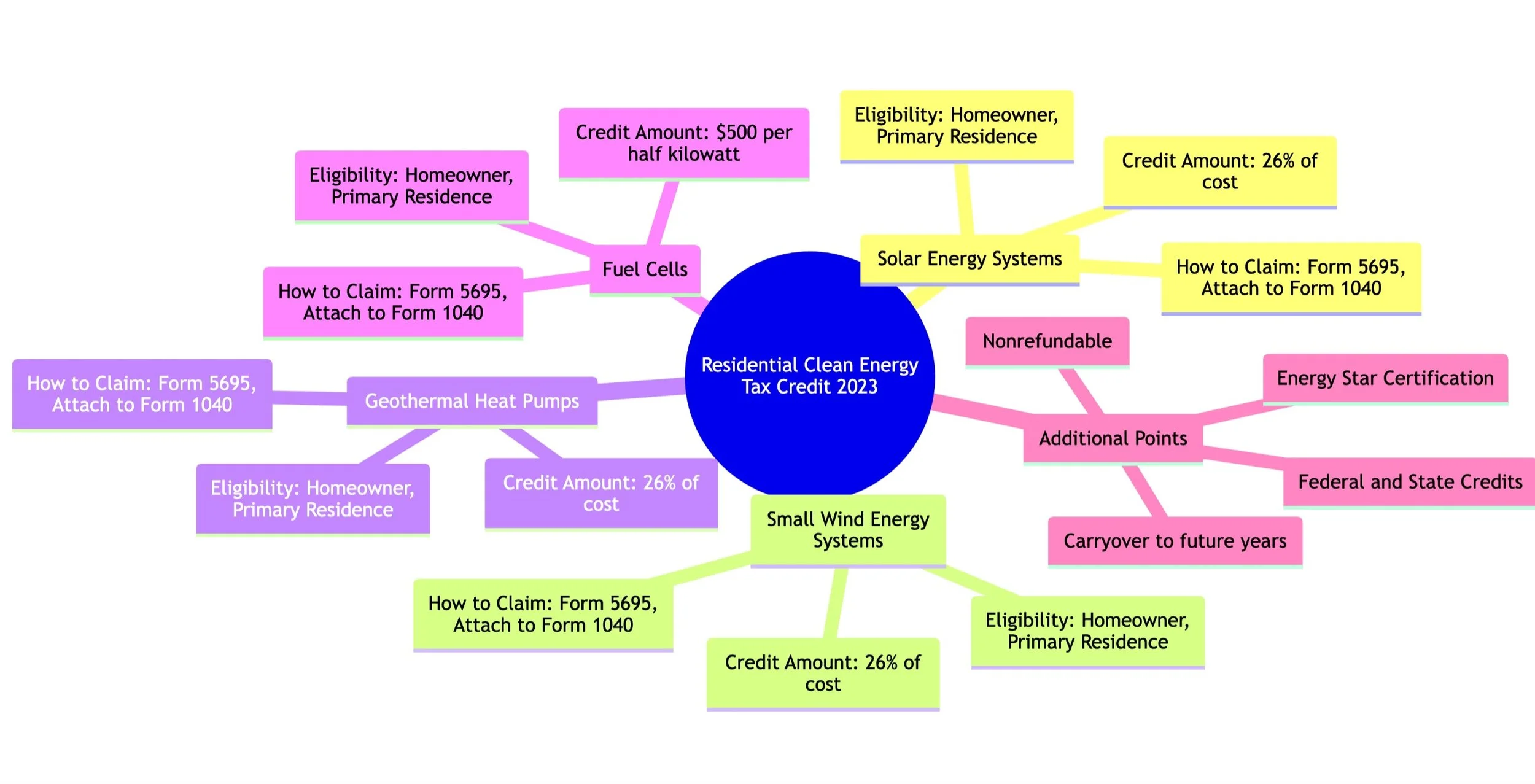

Residential Clean Energy Tax Credit Guide

Introduction

The future is green, and so can be your home! The Residential Clean Energy Tax Credit for 2023 is a fantastic way to make your home more energy-efficient while getting a tax break. This article will walk you through the types of clean energy systems that qualify, the eligibility criteria, and how to claim this credit.

Types of Clean Energy Systems

Solar Energy Systems

Harness the sun's power to generate electricity or heat water.

Small Wind Energy Systems

Utilize wind turbines to generate electricity for your home.

Geothermal Heat Pumps

Use the earth's natural heat for heating and cooling your home.

Fuel Cells

Generate electricity through a chemical reaction without combustion.

Eligibility Criteria

Homeownership: You must own the home where the system is installed.

Primary Residence: The home must be your primary residence.

Credit Amounts by Type

Solar Energy Systems: 26% of the total cost

Small Wind Energy Systems: 26% of the total cost

Geothermal Heat Pumps: 26% of the total cost

Fuel Cells: $500 per half kilowatt of power capacity

How to Claim the Credit

Documentation: Keep all invoices, receipts, and certifications.

Form 5695: Complete IRS Form 5695, "Residential Energy Credits."

Attach to Form 1040: Include Form 5695 when you file your federal tax return.

Additional Points to Consider

Non-Refundable: The credit is non-refundable but can reduce your tax liability.

Carryover: Unused credits can be carried over to future tax years.

State Credits: Check if your state offers additional clean energy credits.

Conclusion

Investing in clean energy systems is not just good for the environment but also for your finances. Make sure to meet the eligibility criteria and follow the claiming process to maximize your benefits.