The 2023 Elderly Tax Credit: A Simple Guide to Savings for Seniors

Introduction

Tax season can be overwhelming, especially for seniors. However, the Elderly Tax Credit for 2023 offers a silver lining. This article will guide you through the types of credits available, eligibility requirements, and the claiming process.

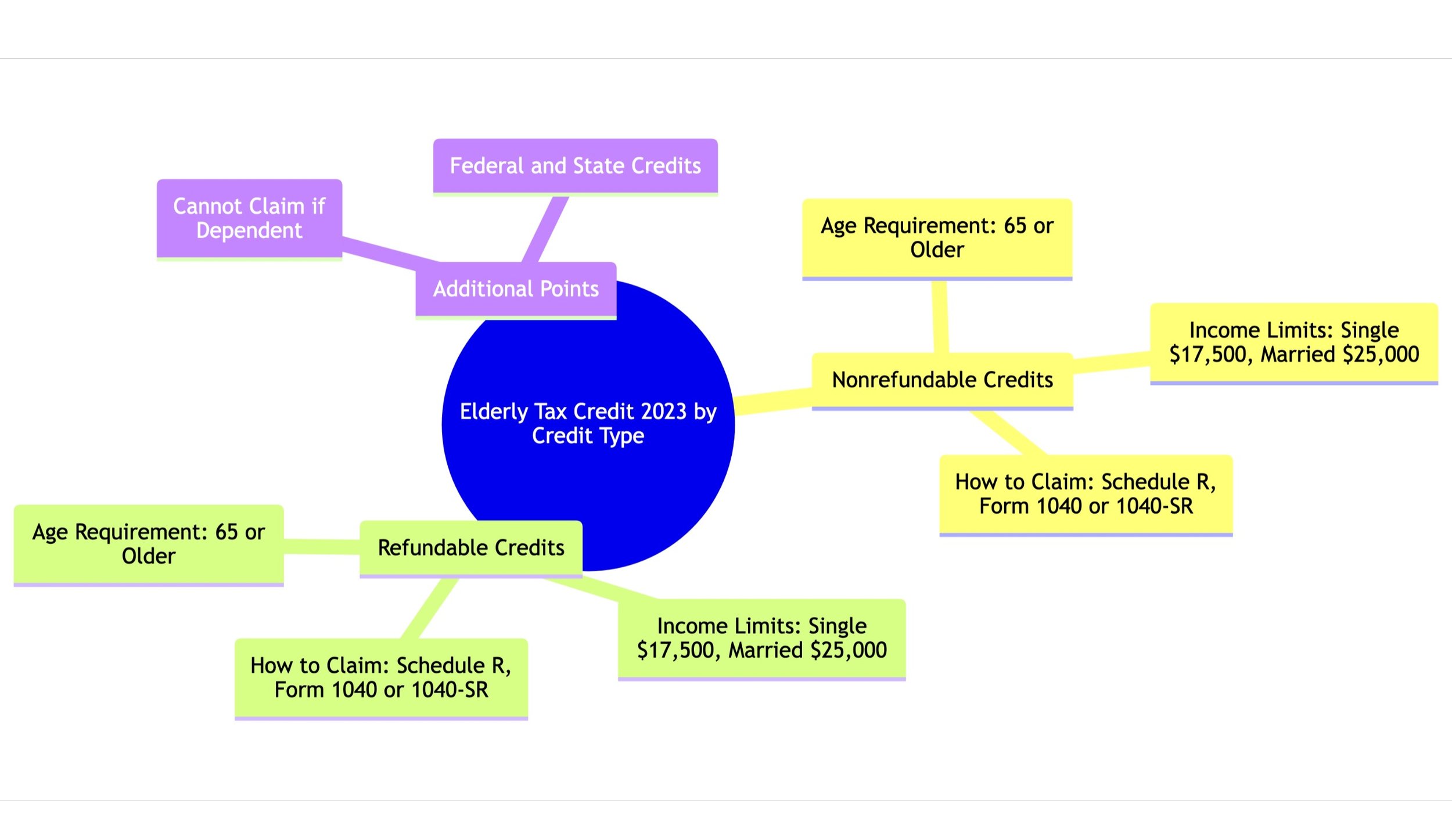

Types of Elderly Tax Credits

Nonrefundable Credits

These credits can reduce your tax liability but won't result in a refund.

Refundable Credits

Although the Elderly Tax Credit is generally nonrefundable, some states offer refundable credits for seniors.

Eligibility Criteria

Age Requirement: You or your spouse must be 65 or older.

Income Limits:

Single: $17,500

Married: $25,000

How to Claim the Credit

Gather Documentation: Keep track of your income and any nontaxable benefits.

Complete Schedule R: This is the form specifically for the Elderly Tax Credit.

Attach to Form 1040 or 1040-SR: Include Schedule R when you file your tax return.

Additional Points

Cannot Claim if Dependent: If someone else claims you as a dependent, you're ineligible.

Federal and State Credits: Some states offer additional credits for seniors.

Conclusion

The Elderly Tax Credit for 2023 is a valuable resource for seniors looking to save on their taxes. Make sure you meet the eligibility criteria and follow the correct steps to claim your credit.