The 2023 Premium Tax Credit: A Simplified Guide

Introduction

The Premium Tax Credit is a financial relief program designed to make health insurance more affordable. As we step into 2023, it's crucial to understand how this credit works, who is eligible, and how to claim it.

Eligibility Criteria

Income Level: Your household income must be between 100% and 400% of the Federal Poverty Level (FPL).

Coverage: You are not eligible if you have other forms of minimum essential coverage.

Family Size: The size of your family also affects your eligibility.

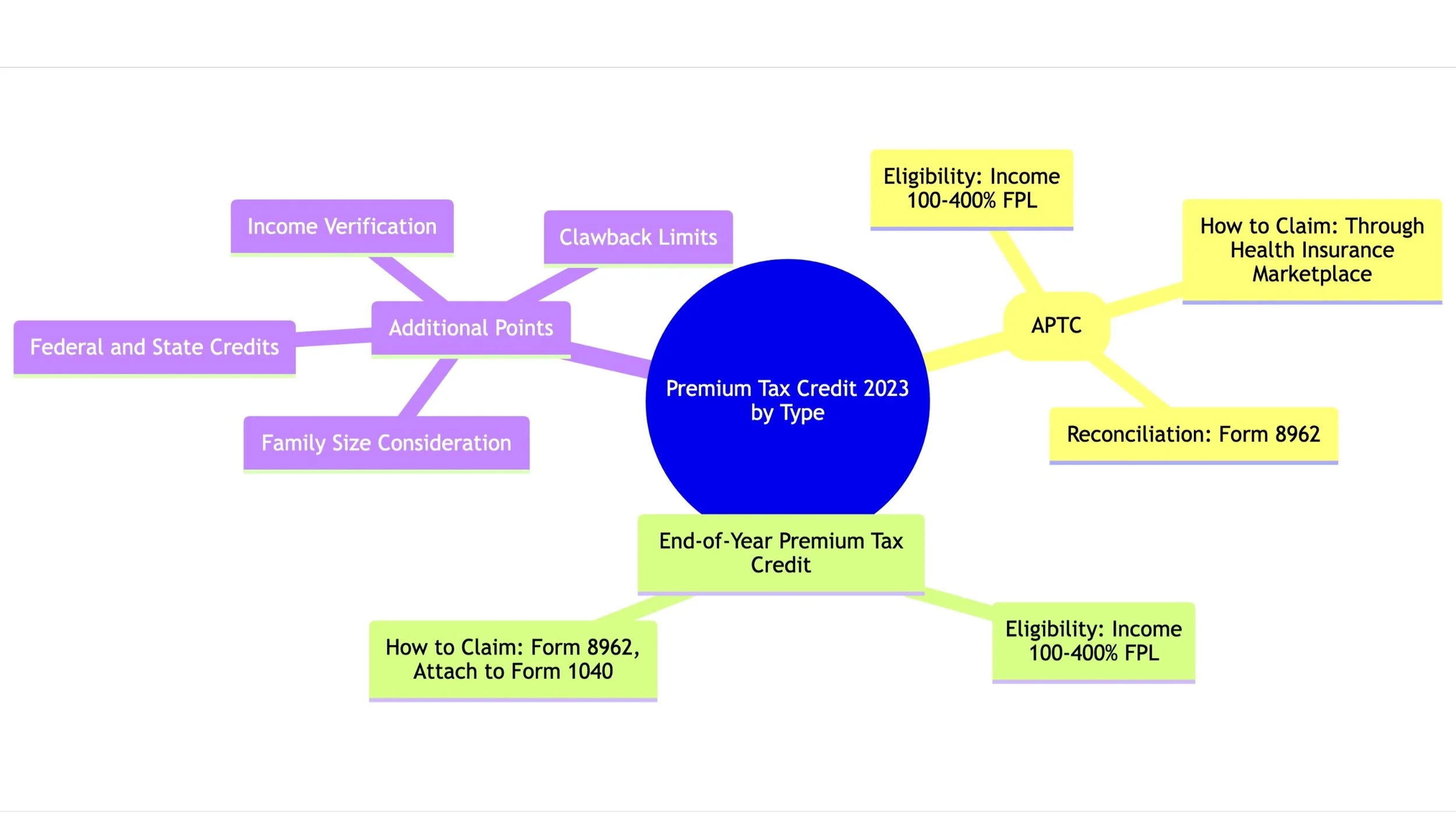

Types of Premium Tax Credits

Advance Premium Tax Credit (APTC): This is paid directly to your insurance company to lower your monthly premium.

End-of-Year Premium Tax Credit: If you didn't get the APTC or if your circumstances changed, you could claim this when you file your taxes.

How to Claim

Health Insurance Marketplace: Initially, you apply for the credit when you purchase insurance through the Health Insurance Marketplace.

Form 8962: At the end of the year, you'll reconcile the amount you received with the actual credit you qualify for using IRS Form 8962.

Attach to Form 1040: Include Form 8962 when you file your federal tax return.

Reconciliation

Form 8962: You must reconcile the APTC received with the actual credit you're eligible for.

IRS Notice: If there are discrepancies, the IRS will send you a notice with further instructions.

Additional Points

Income Verification: You may need to provide documents to verify your income.

Clawback Limits: If your income increases during the year, you may have to pay back some of the APTC.

Federal and State Credits: Some states offer additional health insurance credits.

Conclusion

Understanding the Premium Tax Credit can save you significant money on your health insurance. Ensure you meet the eligibility criteria and follow the steps to claim your credit effectively.