Navigating the 2023 Mileage Deduction for Self-Employed Individuals

Introduction

For self-employed individuals, every penny counts, and tax deductions can make a significant difference. One such deduction is the mileage deduction, which can help offset the costs of using a vehicle for business purposes. In this article, we'll explore the 2023 mileage deduction, its eligibility criteria, and how to claim it.

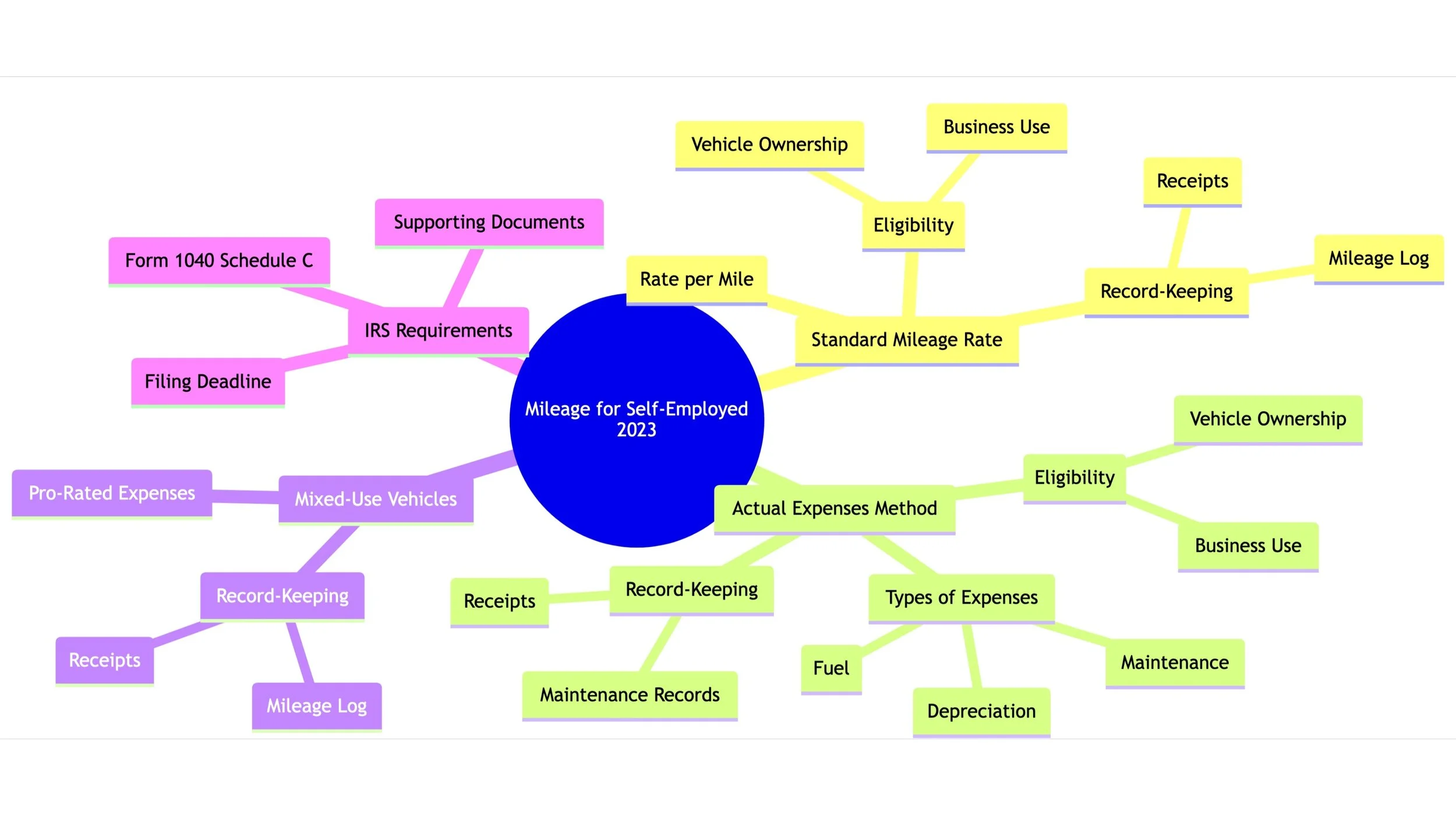

Types of Mileage Deduction

Standard Mileage Rate

Eligibility: Must use the vehicle primarily for business and own or lease the vehicle.

Rate: The IRS sets a standard rate per mile each year.

Record-Keeping: Maintain a detailed mileage log and keep all related receipts.

Actual Expenses Method

Eligibility: Must use the vehicle primarily for business and own or lease the vehicle.

Expenses: Includes fuel, maintenance, and depreciation.

Record-Keeping: Keep all receipts and maintenance records.

Mixed-Use Vehicles

Eligibility: Vehicles used for both personal and business purposes.

Expenses: Pro-rated based on the percentage of business use.

Record-Keeping: Maintain a detailed mileage log and keep all related receipts.

Eligibility Criteria

Business Use: The vehicle must be used primarily for business activities.

Ownership: You must either own or lease the vehicle.

Documentation: Proper record-keeping is crucial for both methods.

How to Claim the Deduction

Choose a Method: Decide between the Standard Mileage Rate and the Actual Expenses Method.

Keep Records: Maintain a detailed log of miles driven for business, dates, and the purpose of each trip. Keep all related receipts.

Fill Out IRS Form 1040 Schedule C: This is the form used to report income and expenses from your business.

Attach Supporting Documents: Include your mileage log and any other relevant documents.

Submit Your Tax Return: File your tax return by the deadline, usually April 15th.

Conclusion

The mileage deduction can be a valuable tax-saving tool for self-employed individuals. By understanding the eligibility criteria and the claiming process, you can maximize this benefit. Always consult with a tax professional to ensure you're meeting all IRS requirements.