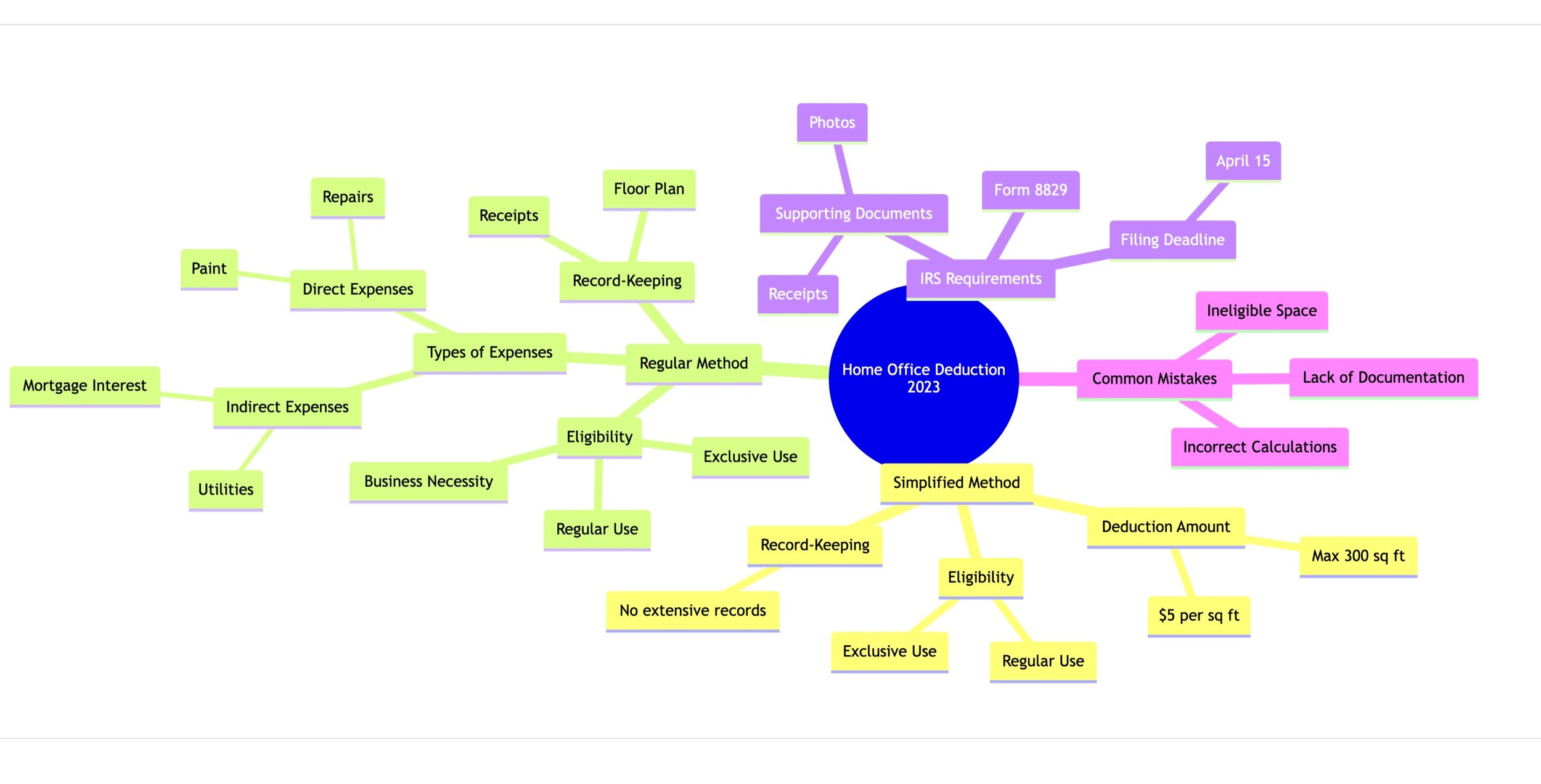

The 2023 Home Office Deduction: A Simple Guide on Eligibility and Claiming

Introduction

Working from home has its perks, and one of them is the potential for a tax deduction. The Home Office Deduction is designed to help self-employed individuals and certain employees offset the costs of maintaining a home office. In this article, we'll dive into the details of the 2023 Home Office Deduction, including eligibility criteria and how to claim it.

Types of Home Office Deduction

Simplified Method

Eligibility: The space must be used exclusively and regularly for business.

Deduction Amount: $5 per square foot, up to a maximum of 300 square feet.

Record-Keeping: No need for extensive records, but basic documentation is advised.

Regular Method

Eligibility: The space must be used exclusively and regularly for business and be essential for your business.

Types of Expenses:

Direct Expenses: Costs like paint and repairs that are solely for the home office.

Indirect Expenses: Costs like utilities and mortgage interest that are for the entire home but can be partially deducted.

Record-Keeping: Keep all receipts and even a floor plan to indicate the portion of the home used for business.

Eligibility Criteria

Exclusive Use: The space must be used only for business activities.

Regular Use: The space must be used on a regular basis for business.

Business Necessity: For the Regular Method, the space must be essential for your business operations.

How to Claim the Deduction

Choose a Method: Decide between the Simplified and Regular Methods.

Gather Documentation: Collect all necessary receipts and even photos of the space.

Complete IRS Form 8829: This form is used to calculate and claim the Home Office Deduction.

Attach to Tax Return: Include Form 8829 when you file your federal tax return.

Submit by Deadline: The typical filing deadline is April 15th.

Common Mistakes to Avoid

Using an ineligible space for the deduction.

Incorrectly calculating the deductible amount.

Failing to keep adequate documentation.

Conclusion

The Home Office Deduction can be a valuable way to reduce your tax liability, but it's crucial to understand the eligibility criteria and claiming process. Always consult a tax professional to ensure you're meeting all IRS requirements.